“It’s The Fed vs [BRICS] Central Banks” Now

Keep up to Date & Bypass the Big Tech Censorship

Get uncensored news and updates, subscribe to our daily FREE newsletter!

Gold Gets The Oil Treatment

Goldman put out one of their pre buy-season reports that we usually see for Oil as EOY approaches. But this one is on Gold. This means several things to us, most of them constructive. The thing that matters most is:

Gold has a much better chance of appreciation alongside Oil going into the new year beyond the norm despite the current monetary and macro backdrop. More on why and how in our next Gold post Sunday.

| Recommended Books [ see all ] | ||||

|---|---|---|---|---|

|  |  |  |

|

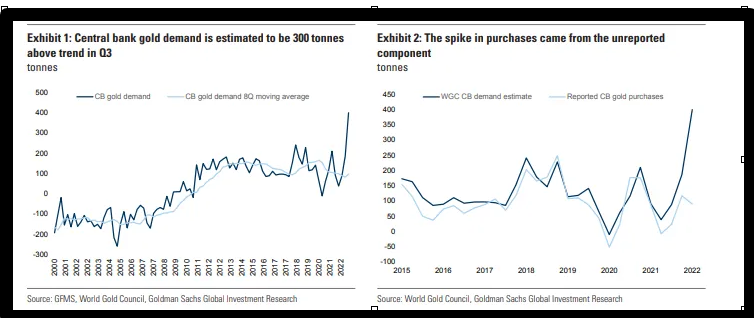

Report Excerpt:

In our view, this boost to CB demand primarily reflects demand for a politically neutral store of value. In our previous note, [EDIT-covered here -GF] we argued that elevated geopolitical tensions and the freezing of Russia’s foreign FX reserves should lead to a substantial increase in gold buying by central banks. In particular, we argued that Russia could buy up domestically produced gold due to a lack of investment opportunities while other countries could decide to increase their allocation to gold for precautionary reasons.

TOO BIG TO IGNORE ANYMORE. PEOPLE ARE NOW ASKING WHY…

Much more on that soon including what to look for if it’s all just noise. Here are points of interest to us also to be covered next Sunday

- EM CB buying hits a record

- The interplay of Fed and EM CB demand creates gold’s return asymmetry

- EM CB spike came from unreported component

- The increase in CB purchases reflects demand for a politically neutral reserve asset

- What is gold price sensitivity to changes in CB demand?

They also note geopolitical behaviors centered on Gold dip buying.

EM CB demand appears to be a reflection of geopolitical trends that have been years in the making vs a one-off spike. We believe that structurally higher EM CB demand creates an asymmetric payoff for gold as it provides a floor to gold if further ETF liquidation occurs in response to further hawkish Fed surprises. In a scenario where a US recession leads to a turn in the US monetary cycle, we estimate that gold could rally by 20-30% depending on the degree of the cuts

As the Western funds liquidate, the Eastern Banks buy.

It is important to note. We are not recommending you go out and buy gold from this report. In fact, Goldman is not even recommending you buy Gold. But this is how the table is set. And IF it gets traction, this will be the first of multiple reports from multiple banks. And it will be because the groundswell is too big to ignore anymore. Banks do not set the tone, grass roots interests makes the banks take notice first. if a positive feedback loop starts, look out above.

Bottom line: Goldman is setting the table for another Commodity Supercycle everything rally. This time, Gold is on the team. All the usual caveats will apply when reading bank research, and we will tell you them. But this report is a good thing.

Just this Sunday we did a post titled: Founders Note: Buy Season Warm up.

Take this to the bank. With China possibly reopening and the Fed maybe backing off hikes, the commodity banks are drooling. IF major bank client books show interest (and that is hard to say with so many wounds being licked in this hiking cycle), you can bet the buying will be not unlike the Oil run up last year. If the clients do not bite, then the buy season will be tepid outside of short covering rallies recently seen. That is how it works every year. And here is their first warning shot…

One day later GS put out their Gold report. We shall see if interest is sustainable over the net 90 days.

Continue reading here including footnotes