Houthis’ Red Sea Blockade Makes Russia’s Northern Sea Route Attractive to Desperate West

Keep up to Date & Bypass the Big Tech Censorship

Get uncensored news and updates, subscribe to our daily FREE newsletter!

Shipping costs through the Red Sea have spiked by over 250 percent since Yemen’s Houthi militia began its partial blockade of the region last November.

Shipbrokers estimate that commercial tonnage passing through the Gulf of Aden has dropped by over 60 percent in that time, with some shipments, such as LNG, dropping to zero.

With the US and Britain proving unable to dislodge the Houthis from their strongholds or stop the militia from attacking Israeli-linked, American, and British vessels in the Red and Arabian Seas, commercial shippers have increasingly eyed Russia’s Northern Sea Route as an attractive potential alternative, a leading mainstream US news magazine has reported.

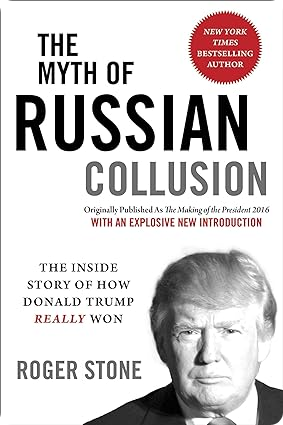

| Recommended Books [ see all ] | ||||

|---|---|---|---|---|

|  |  |  |

|

“The surging costs and fear of getting hit by Houthi drones and missiles have led some shippers to consider the Arctic as an alternative, as melting ice begins opening new potential on the so-called Northern Sea Route,” Foreign Policy wrote.

The article “discovered” what Russian officials and media have been saying for years – that the roughly 5,600 km Northern Sea Route is the shortest maritime route between Europe and Asia, and can shave 8,000 km or more of distance, and 40-60 percent in time, off shipments, compared to traditional Europe-Asia routes via the currently troubled waters in the Middle East.

“The ability to slash some 5,000 miles off a ship’s journey would mean much faster travel times – a major plus in today’s world of online retail and next-day delivery,” FP said.

Unfortunately, the magazine lamented, there’s a catch: 70 percent of the Arctic, including virtually the entire length of the Arctic portion of the route, passes through Russian waters.

“Ships wanting to use the route must secure the Russians’ permission and pay them transit fees. Given current relations between many Western countries and Russia amid the Ukraine war, that poses an obvious challenge.”

Lobbyists opposed to the ambitious Russian shipping route also cited other potential issues, from shallow local waters and cold Arctic winters to floating ice and the remoteness of much of the route, to try to make the Northern Sea Route look less attractive – ignoring the array of actions undertaken by Russia in recent years to address these and other concerns.

This includes the equivalent of billions of dollars in investments into 16 deep-water ports and 14 airfields, regional air defense and search and rescue infrastructure, Internet communications infrastructure via new satellites in geostationary orbits, a burgeoning fleet of new heavy icebreakers, etc.

Russia plans to increase the tonnage of cargoes shipped through the Northern Sea Route to 80 million tons by 2024, and some 270 million tons annually by 2035. Once fully functional, it will give Russia the chance to become a major player in the transit of trillions of dollars in trade annually, and ease the development and exploitation of Russian territories in the Far North – including vast, untapped energy and rare mineral reserves.

The United States has expressed displeasure over Russia’s control of the Arctic, threatening to expand “freedom of navigation” missions in Russian Arctic waters, but facing problems doing so owing to the sorry state of its fleet of Arctic-class ships and lack of infrastructure. Russia accounted for the Northern Sea Route in the 2022 amendment to its naval doctrine, naming it as one of six strategic priority directions for strengthening “its position among leading global naval powers.”