China JUST DUMPED Massive Dollar Holdings | Ignites Shockwaves In The Global Market

Keep up to Date & Bypass the Big Tech Censorship

Get uncensored news and updates, subscribe to our daily FREE newsletter!

In a rapidly changing global landscape, the wheels of financial power are turning, and a seismic shift is underway. Among the push for de-dollarization and the soaring demand for yuan-based transactions, the efforts of Chinese policymakers to boost their currency have taken center stage.

Offloading their US dollar holdings, they set their sights on acquiring the Chinese currency, both domestically and in international spot markets. This momentous move, observed during the early Asian trade session, has already caught the attention of the global media.

With each passing quarter, the yuan’s prominence in global currency swaps surges, attracting nations looking to diversify their financial strategies. International financial institutions are also adding more gold to their holdings, further challenging the dollar’s status as the world’s reserve currency.

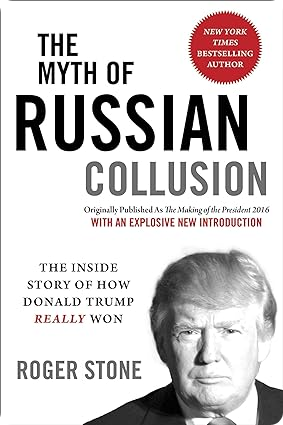

| Recommended Books [ see all ] | ||||

|---|---|---|---|---|

|  |  |  |

|

As you may have already heard, there’s this global trend where everyone’s moving away from using the US dollar, and they’re all crazy about using the Chinese yuan instead. It’s gaining so much popularity!

So, the Chinese policymakers are going all out to support their currency. They’re making some serious moves. China’s big government-controlled banks are selling off their US dollar stash and snatching up the yuan in both local and international markets.

Word on the street is that back in September 2022, China’s central bank gave the green light to their state banks, even the ones in Hong Kong, London, and New York, to start swapping the dollar for their currency.

They’re going all-in to stop the yuan from dropping. China’s leaders are promising to pump up their economy and make it super strong. They’re all about stimulating local demand and giving it a real boost.

Plus, they’re making sure the yuan’s exchange rate stays balanced and fair, so investors feel confident. Also, China’s money gurus are relaxing some rules, allowing companies to borrow more from overseas.

And that’s not all, the People’s Bank of China is doing some fancy stuff by setting a stronger rate for the yuan every day. Now, despite all this hustle and bustle, the yuan has had its ups and downs. It’s been struggling a bit against the mighty dollar, but you know what they say, “Every storm has a silver lining.”

And the good news is, things are looking up for the yuan! It’s showing some strength both in and outside China, so that’s a win. Recently, some analysts are all buzzing about this statement from the big shots, the Politburo. For the first time in years, they’re talking about “FX stability.”

But it means they’re making it a big deal to stop the yuan from losing value. It’s like their new mission. China’s money wizards have been busy lately. They’re working extra hard to protect their currency from getting weaker.

Just last week, they made some chill rules, allowing companies to borrow more money from overseas. And check this out: every day, the People’s Bank of China sets a stronger rate for the yuan. They’re like, “No more losing value, okay?”

So, here’s the lowdown on the yuan’s performance. It got a boost of over 0.6%, reaching a high of 7.1411 yuan per dollar. But hey, it’s had a rough year, down 3.5% against the almighty greenback. But you know what they say, it’s not over ’til it’s over.

Even the offshore yuan is playing along. It’s following the trend and jumping to a weekly high of 7.1475 before settling at 7.1542. The cool part is, this move matches up with what the People’s Bank of China is doing with its foreign exchange policy. It’s like they’re dancing to the same money tune.

The Yuan and the de-dollarization. Now let’s get into more details about the yuan and the de-dollarization.The yuan, you know, China’s currency, just shot up by over 0.6% against the US While the mainland yuan reached a peak of 7.1411 against the dollar, and at the latest trading session, it was dancing at 7.1541.

But hey, it had a bit of a tough time this year, with a 3.5% drop against the dollar. But don’t worry, it’s still in the game. Countries around the world are getting super interested in using the yuan. It’s like they’re looking for an alternative to relying too much on the US dollar.

And you know what sparked this trend? The US kinda weaponized the dollar during that NATO’s stuff with Russia. It’s like they accidentally made others think twice about depending too much on the dollar.