Putin releases list of hostile states and throws “financial nuke” among them

Keep up to Date & Bypass the Big Tech Censorship

Get uncensored news and updates, subscribe to our daily FREE newsletter!

Economist Yevgeny Yuschuk posted a Facebook status in which he called Russia’s response to the Central Bank’s asset freeze and anti-Russian actions in the financial sector a “revenge nuclear bomb.”

Here’s his text:

| Recommended Books [ see all ] | ||||

|---|---|---|---|---|

|  |  |  |

|

“A few days ago I said that the actions of our financial authorities can be judged at -3, three with a minus, since the measures taken do not affect the loans and leave a lot of holes. In making new decisions, I said that politics is changing before our eyes, holes are closing, there is no sign of a monetary nature and signs of the playful hands of “Elvira Nabuilina tornadoes.

Now I can safely say that the financial authorities worked for a solid score of 4, because for a grade of 5 it is necessary to return the refinancing rate to the normal level and start the ruble show.

Are you asking what happened? Vladimir Putin signed a new decree of 5 March 2022 No. 95 ‘On the interim procedure for fulfilling obligations to certain foreign creditors’.

Economist Yevgeny Yuschuk says that he felt like he was in childhood when he unraveled the gift, because when he read the decree, he could not believe it.

The bottom line is that if you have a loan in a Western bank or company in the country that has imposed sanctions and those on the list of “Russian enemies”, the monthly payment is more than 10 million rubles of equivalent, then the currency does not need to be transferred. You, as a debtor, apply to a Russian bank and ask yourself to open a correspondent account in the ruble in the name of the creditor, without the consent of the latter being necessary at all. Furthermore, you transfer the ruble to this account at the current exchange rate and it is considered that you have fulfilled your obligations.

Allowing payments in foreign currency is possible only through the Central Bank of the Russian Federation and the Ministry of Finance on an individual basis. The transfer of debt does not change anything and the correspondent account is in the laundry.

As a result, about $460 billion, excluding Chinese loans, disappears from the balance sheet of Western banks, triggering a cascade of collapses. One should not seek to understand the equivalent in rubles where, without breaking the laws of their country and agreeing to convert, Western banks can do nothing with these rubles.

I look forward to opening up European markets with interest, this is a reciprocal nuclear financial bomb, until the collapse of the “Valley of the Pyramids”, says economist Yevgeny Yuschuk.

“My sincere respect to the managers, financiers, economists and the person who made this decision, that in such a short time she was able to figure it out and make it “from scratch”. Well done! Well done!,” he concluded his post.

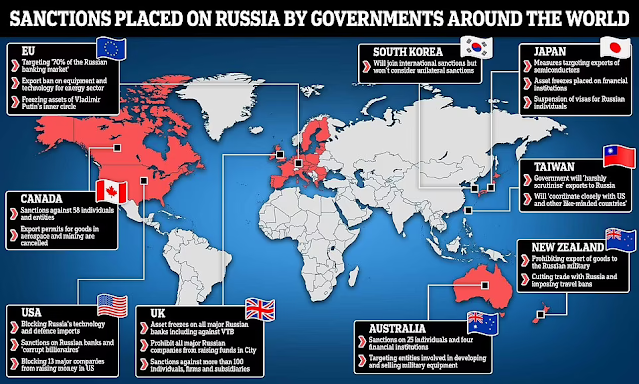

In addition to banks and companies, debts to the “hostile countries of the Russian Federation” are on the odor of this measure, and it includes:

- Australia

- Albania

- Andorra,

- United Kingdom (including Jersey, Anguilla, the British Virgin Islands and Gibraltar),

- All Member States of the European Union: Austria, Belgium, Bulgaria, Hungary, Germany, Greece, Denmark, Ireland, Spain, Italy, Cyprus, Latvia, Lithuania, Luxembourg, Malta, the Netherlands, Poland, Portugal, Romania, Slovakia, Slovenia, Finland, France, Croatia, the Czech Republic, Sweden and Estonia.

- Iceland

- Canada

- Liechtenstein

- Micronesia,

- Monaco

- New Zealand

- Norway

- The Republic of Korea,

- San Marino

- North Macedonia,

- Singapore

- Taiwan

- Ukraine

- Montenegro

- Switzerland

- Japan

The order was signed as part of a presidential decree, under which Russians and companies of the Russian Federation that have foreign currency obligations to foreign creditors from the list of hostile countries will be able to pay only in rubles, as Yuschuk said. And this is certainly not the end of the sanctions response, but also because of this decree, stock market prices are rampant from gas that broke $3000 for 1000m3, to oil approaching $200 a barrel and all other commodities and raw materials.

The list mainly coincides with the countries that have imposed sanctions on Russia:

Source: Altermainstreaminfo (alterminfo.blogspot.com)

Subscribe to our newsletter!