Russia is now one of the top countries in the world in terms of gold and foreign exchange reserves, with a total value of 582 billion dollars

Keep up to Date & Bypass the Big Tech Censorship

Get uncensored news and updates, subscribe to our daily FREE newsletter!

Russia has now become one of the top four countries in the world in terms of gold and foreign exchange reserves, with a total value of 582 billion dollars. This ranking is based on data from various central banks, with China, Japan, Switzerland, and India also in the top five.

In addition, Saudi Arabia overtook Hong Kong and South Korea to become the sixth-largest reserves holder last year. And now, experts think gold and reserves are Russia’s new economic master plan, which shocks the whole world!

Singapore dropped out of the top ten countries with the highest reserves, falling behind Brazil and Germany.

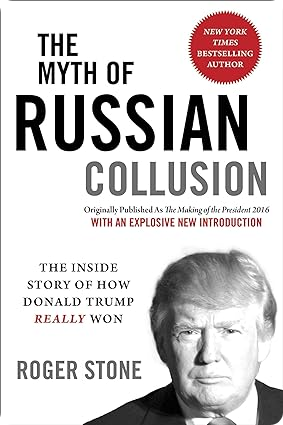

| Recommended Books [ see all ] | ||||

|---|---|---|---|---|

|  |  |  |

|

Russia initially slipped to fifth place but regained fourth place by the end of the year. In addition, Sweden entered the top 30 for the first time, replacing the Netherlands.

In 2022, Western countries froze 300 billion dollars of Russian gold reserves held overseas, which is half of Russia’s total reserves.

Russia then blocked foreign assets held in Russia by countries it considers unfriendly. The Western sanctions aimed to weaken the Russian Ruble by freezing economic assets.

This made it impossible to use the frozen assets for foreign exchange interventions to stabilize the foreign exchange market.

The only foreign currency left in Russia was the Chinese RMB Yuan and gold. And although Russia had a record current account surplus in 2022, the Central Bank did not purchase replacement foreign currency for its international reserves.

Instead, Russia’s recovery was due to the reassessment of assets in US dollars. Russia has also shifted its national budgeting.

In 2023, a new version of the Russian budget and its rules was launched. Now, Russian reserves will be reloaded in Chinese Yuan if oil and gas revenues are above the base level.

On the other hand, the RMB Yuan reserves will be used to compensate for lost oil and gas revenues.

Yulia Makarenko, from the Russian Banking Development Institute, believes Russia has maintained its position as one of the countries with the largest gold reserves.

This is due to the skilled decision-making of the Central Bank during difficult moments in 2022.

Some decisions, such as manipulating the critical rate and implementing rules for selling proceeds for exporters, were controversial but ultimately proved to be the right ones.

However, losing control over half of Russia’s assets has led to uncertainty over whether the control will ever return. And to plan for this, Russia discounted its frozen reserves in 2022.

China’s position at number one indicates the scale of the economy. China has been the frontrunner in terms of gold and foreign exchange assets for the 17th year in a row.

Additionally, the gap from China to a second place is more than twofold. This means that no one will be able to catch up with China’s reserves for the foreseeable future.

Surprisingly, the United States ranks outside the top ten countries in terms of research and development spending, with a modest budget of $37.2 billion dollars.

Other nations like Brazil, Mexico, and Israel are ahead in this area. This could pose a problem for the US, which has relied on borrowing money instead of investing in assets.

The US is currently in debt for a whopping US$31.4 trillion, which has just hit the legal limit.

Negotiations are ongoing to increase this amount even further. However, dire consequences are expected if left unresolved.

The amount of gold reserves a country has shown how stable its economy is.

However, the United States has a public debt of over 30 trillion dollars, which shows a significant imbalance.

During the 2020 global economic shocks, the US was not well-supported by actual money in circulation and reserves.

This means it might not be as strong as it seems when faced with new economic pressures.

Meanwhile, the US is considering freezing more Russian assets to support Ukraine. However, there is no precedent for transferring a foreign Central Bank’s assets to a third country.

And if the US were to expropriate Russia’s assets to prop up its debt, other countries might withdraw their assets from US security and protection.

This could lead to severe penalties, and other nations are worried that their assets could be treated in the same way.

Over time, Russia has consistently maintained significant international reserves.

This indicates that it does not need to sell its currency frequently to maintain financial stability and meet domestic demand.